Our Security Center is full of helpful information about protecting the security of your accounts, personal information, home computer, and your identity.

Protect Yourself from Scams

Scammers will try anything to get your personal information. Remember, EECU will never contact you and ask for your SSN, passwords, and other personal information.

Holiday Scams

‘Tis the season for festive holiday lights, warm nights by the fire, and scammers who want to steal your personal information.

Don’t let scammers put a damper on your holiday cheer. Here are some common scams and tips to help you stay safe.

Online shopping scams

Do you research before ordering anything from an ad you saw on social media or online. Scammers use fake posts and ads to lure you to copycat websites of major retailers or to sites for retailers that don’t even exist. Make sure the site you are on is a legitimate site; read consumer reviews and visit the Better Business Bureau website before placing an order.

Delivery scams

Beware of fake shipping notices this holiday season. Scammers send emails and text messages that appear to be from FedEx, UPS, or the USPS about package deliveries with a link for more information. If you click the link it may download malware onto your device. To track a package you ordered, use the information in the email or text you received from the store when you placed the order.

Charity Scams

Fake charity sites are popular during the holidays when people are in the giving spirit. If you want to make a charitable donation, research the organization first by visiting websites such as the BBB Wise Giving Alliance and Charity Navigator.

Romance Scams

Romance scams are a cruel form of deception where criminals exploit the desire for love and connection while gaining the affection and trust of the victim. They craft online personas, often using stolen pictures and profiles, to build a facade of affection. Their goal? To manipulate victims into parting with money or sensitive information. Preying on emotions, they create a strong bond, making it easier to exploit people. The emotional investment makes it harder for victims to recognize or admit the scam, leading to devastating financial and personal consequences.

The two most common ways scammers find their victims is by creating a fake persona to meet people on dating apps or randomly texting people and starting conversations. Have you ever received an odd text message simply saying “Hi” or looking like a wrong message to the wrong person? These are romance scammers trying to start up conversations with lonely people.

Spotting and Stopping Romance Scams

- Too Good to Be True: If someone seems like the perfect match quickly and the relationship progresses rapidly, it might be a red flag. Scammers often create ideal profiles to lure in victims.

- Love at Lightning Speed: Scammers express deep feelings and propose a serious commitment very early into the interaction to catch their victims off guard. Genuine connections take time to develop. Beware of whirlwind romances and professions of love that seem unrealistic.

- Never Able to Meet: Often citing living overseas or being in the military, scammers usually have elaborate excuses for why they cannot meet in person.

- Requests for Money: A telltale sign of a romance scam is when the person you are communicating with asks for money, especially under the pretext of emergencies, travel expenses, medical bills, or visas. Never send money or financial information to someone you haven't met in person.

- Avoidance of Video Calls: Scammers usually avoid video calls or repeatedly cancel virtual meetings at the last minute. They might use fake or stolen photos and want to avoid being identified.

- Secrecy and Isolation: The scammer may attempt to isolate you from friends and family or discourage you from discussing the details of the relationship, fearing that others might offer warnings against the scam. Don't be afraid to confide in loved ones about your online relationship. Their objective viewpoint can be invaluable.

- Changes in Communication Style: If you notice inconsistencies in grammar, spelling, or story details that don’t seem to align with previous communications, it could be multiple scammers operating the same profile.

Romance scams lead to significant emotional and financial damage, making them one of the most harmful scams. Be careful with your personal information and finances in any relationship, especially one that starts online. If you ever feel pressured to send money or share financial details, it’s a strong signal that something could be wrong. Remember, it's not just about protecting your finances and personal information but also guarding your heart.

Source: SANS Institute

Tech Support Scams

Have you heard about tech support scams? In the latest twist on these scams, fraudsters prey on your fears that you have been hacked and they trick you into transferring money from your account to “protect it.”

According to the Federal Trade Commission, scammers use fake security pop-ups on your computer to get you to call a number. When you call, they say that your bank or retirement account has been hacked. They may transfer your call to another scammer who pretends to be with a government agency. To protect your money they tell you to transfer it to a new account. Once you do, they will quickly drain the account.

Remember:

- Never call a number on a security pop-up warning; this is always a scam.

- Never move or transfer your money to protect it; only scammers tell you to do that.

- Never give someone a verification code to log in to your account.

- Call your real bank or investment advisor if you are concerned, using a number you know is real.

Source: Federal Trade Commission

‘Zelle Fraud’ Scam

Zelle is a popular “peer-to-peer” (P2P) payment serviced used by many financial institutions to allow their customers/members to send money to other people. Although EECU does not offer Zelle, we want you to be aware of this scam involving financial institutions that offer Zelle.

Victims receive a text message from the scammer that appears to be from their financial institution regarding a Zelle payment. After responding to the text message, they receive a call from the scammer that appears to be from their financial institution – the scammer has spoofed the phone number to make it appear as though the call is coming from their financial institution. They inform the victim that they can reverse the unauthorized Zelle transaction and all they need is the victim’s online banking user name so they can verify their identity.

Armed with the user name, the scammer then uses the Forgot Password feature to gain access to the victim’s online account. A one-time authentication passcode is sent as part of the Forgot Password feature, and the scammer asks them to read the code back. With the code, the scammer can now complete the password reset process, gain access to the victim’s online account, and transfer money out of the account using Zelle.

EECU and other financial institutions will never ask you for your online banking password, authentication passcodes, or other login specific information. If you receive a text message or call like this, do not give out your online banking credentials or account information. Do not reply; delete the message and hang up on the caller. Call your financial institution directly if you have questions about a transaction or account activity.

If you use Zelle, we encourage you to visit their website for resources and tips for safe payments using Zelle. https://www.zellepay.com/financial-education/resources-tips-safe-payments

Phone, Text and Email scams

Don’t rely on caller ID as verification of who is calling. Scammers can spoof phone numbers to make it look like the call is coming from your bank, Social Security Administration, the IRS, or another company. Call the company using the phone number on their website or an account statement to determine if the request is legitimate. Be very cautious of phone calls, texts and emails requesting your personal information, such as your debit or credit card number, Social Security number, password, account numbers and other personal information, and be sure to contact us if you fall victim to one of these types of scams

Gift Card Payment Scam

If you are asked to purchase a gift card to pay for something, it’s a scam. Anyone who demands payment by gift card is always a scammer. Read this Federal Trade Commission article about gift card scams for more information.

Internet Scams

It is important to understand how to recognize internet scams. Internet crime schemes steal millions of dollars each year from unsuspecting victims. The Internet Crime Complaint Center is a great resource of information regarding Internet Crime. It has been established through a partnership between the Federal Bureau of Investigation (FBI) and the National White Collar Crime Center (NW3C).

Card Cracking Scams

Card cracking is a type of account fraud. Scammers promise money or some other form of payment in exchange for access to your account. You may be asked for your bank account information, debit card PIN, or online banking credentials. Once the scammer has access to your account they deposit fraudulent checks and then quickly withdraw the money at ATMs before the fake check(s) is discovered; they may give some of the cash to you. When the check bounces and causes your account to go into the negative because you gave the scammer your debit card, PIN, or online banking login, you are responsible for paying that money back.

Remember, if something sounds too good to be true it probably is. Never give your account credentials, debit card PIN or other personal information to someone else.

Ransomware Scam

Individuals and businesses have become targets to a growing online fraud scheme known as ransomware.

Ransomware is a form of malware used by cyber criminals to freeze your computer or mobile device, steal your data and demand that a “ransom” — typically anywhere from a couple of hundreds to thousands of dollars — be paid.

According to the FBI, ransomware victims lost more than $18 million between April 2014 and June 2015. Here are some tips to help you combat these malicious threats.

- Don’t click. Visiting unsafe, suspicious or fake websites can lead to the intrusion of malware. Be cautious when opening e-mails or attachments you don’t recognize even if the message comes from someone in your contact list.

- Always back up your files. By maintaining offline copies of your personal information, ransomware scams will have a limited impact on you. If targeted, you will be less inclined to take heed to threats posed by cyber criminals.

- Keep your computers and mobile devices up to date. Having the latest security software, web browser and operating system are the best defenses against viruses, malware, and other online threats. Turn on automatic updates so you receive the newest fixes as they become available.

- Enable popup blockers. To prevent popups, turn on popup blockers to avert unwanted ads, popups or browser malware from constantly appearing on your computer screen. Source: American Bankers Association

Secret Shopper Scam

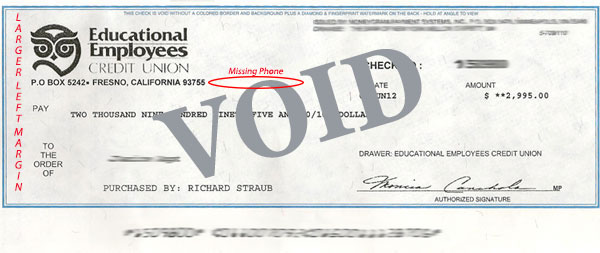

EECU Cashier's Checks Used In Secret Shopper Scam

Recently a group of fraudsters have created counterfeit EECU checks and are sending them to unsuspecting consumers.

These checks are fake. If you receive one of these checks, DO NOT CASH or DEPOSIT.

A sample of a fake check is shown below.

Keep your information safe

Online and mobile banking are part of daily life. Click on one of the links below to learn more about securing your devices, cyber-security, phishing and internet fraud, and more.

Cyber-Crime Impact on Identity Theft and Account Fraud

Internet Devices & Safe Online Banking

Online Banking & The Internet of Things

OnGuardOnline.gov provides tips from the federal government and technology industry to help you be on guard against Internet fraud and protect your personal information.

Mobile Security

- Turn on automatic updates to ensure your device is getting the latest and greatest security.

- Secure your device with a strong password and consider using two-factor authentication, such as a fingerprint or code.

- Install mobile applications from trusted sources and review the application vendor prior to download.

- Do not download software or applications from third-party application platforms or untrusted websites.

- Review application permissions during installation; ensure permissions requested are appropriate for the type of application being downloaded.

- Keep your operating system up-to-date.

- Do not modify your phone’s security settings. Tampering with the settings makes it more susceptible to an attack.

- Install a security app that can remotely locate and wipe your phone if you lose it.

- Install and regularly update anti-virus or anti-malware software on Android devices.

- Do not open or click on hyperlinks in SMS, MMS, or email messages from unknown or suspicious sources.

- Do not open attachments included in unsolicited emails.

- Consider downloading an ad blocker to enable the device’s browser to block advertisements and pop-ups.

- Use only secured wireless connections to access the Internet, taking extreme caution when accessing public Wi-Fi connections.

- Erase all data from your phone before you sell, donate or recycle it.

Account Security

The information below will assist you in protecting yourself against fraud and identity theft. If you're a member of EECU and you feel that you have been a victim of identity theft, please contact us immediately. We can help you.

Introducing Voice Verification

We now offer Voice Verification, which makes identifying yourself when you call our Member Service Center much faster and easier. Instead of answering several security questions to gain access to your account information, with your permission we can easily and securely identify you by the sound of your voice. Voice Verification is secure and the setup is quick and easy. Learn more about Voice Verification.

ATM Safety Tips

- Have your card ready before approaching the ATM. Memorize your PIN; never write it on the back of the card.

- Be extra cautious at night. Bring a friend whenever possible and always choose well-lighted ATMs.

- Scan your surrounding area for suspicious activity. If for any reason you aren’t comfortable, report unusual activity as soon as possible and use another ATM.

- Notify police immediately of any criminal activity you observe at ATMs.

- Inspect the ATM card reader slot and the keypad to ensure both are securely in place. Look over the entire ATM for parts that don’t match in styling, color or material. If you suspect the ATM may have been tampered with, notify the credit union as soon as possible and use another ATM.

- Conceal the number pad with your body when entering your PIN so others cannot see your code.

- Take your ATM card and transaction receipt or select no receipt, email receipt or text receipt.

- Never count cash at the machine or in public. Wait until you are in another secure place.

- Do not lower your window if someone approaches you while in your vehicle. Keep doors locked and windows rolled up.

- If you are followed after leaving an ATM, go to a heavily populated, well-lighted area and call the police.

- If you are involved in a confrontation with an assailant who demands your money, COMPLY.

- Do not provide information about your account or PIN to strangers, not even the credit union.

- If you lose your card, your PIN is compromised, or you discover suspicious transactions on your account, notify the credit union immediately.

Mail Safety Tips

- Pick up your incoming mail every day – do not leave it overnight; or, consider using a P.O. Box.

- Take outgoing mail to the post office or place it in a collection box close to the indicated pickup time.

- Ask the post office to hold your mail if you are going on vacation so that it is not delivered while you are away.

- Sign up for USPS Informed Mail Delivery, a free service that shows you preview images of incoming mail.

- Shred all offers of credit that you receive in the mail and do not plan to use. Never dispose of these items in the trash without first shredding them.

- Enroll in paperless bills for bank statements, credit card bills, utility bills, etc.

- Make a list of all bills and statements you receive and the dates you normally receive them. If you're expecting a bill and you do not receive it, contact the issuer right away.

Telephone Safety Tips

- Never give private information, such as social security number, account or credit card numbers, passwords, etc. over the phone unless you initiated the call.

- A credit union employee will not call you and ask you to provide sensitive account information. You may receive a call from someone claiming to be a credit union employee, and they may ask for your account information (such as your credit card number, account number, etc.). In some cases, the caller has already obtained one identifying piece of information (such as your Social Security Number) and will use this to persuade you that the call is legitimate and that you need to provide additional account information. Do not provide the caller with any sensitive or personal information. Remember - the credit union will not call you and ask for this information.

- Don't agree to any offer or prize where you have to pay a registration or shipping fee, or send money, to claim the "prize."

- Check out charities before you give. Ask for written information before you make a donation.

- Don't be pressured to make an immediate decision.

Password Safety Tips

- Never write your password/PIN down where someone can find it.

- Do not send your password or any other personally identifying information (i.e. social security number, account number, etc.) via e-mail.

- Avoid easy-to-guess passwords/PINs - like birthdays, anniversaries, phone numbers, names, etc. Use a combination of letters, numbers and symbols for passwords.

- Keep your password/PIN private.

Card Safety Tips

Security experts have reported an increase in card skimming, which is the illegal collection of your personal and account information from the magnetic stripe of a credit, debit or ATM card. Read our Financial Fraud Update – Card Skimming brochure to learn more about card skimming and what you can do to help prevent it from happening to you.

Identity Theft

Identity theft occurs when someone uses your personal information to obtain access to your existing accounts, or open new accounts or credit lines in your name. Thieves may gain access to your personal information in a number of ways:

Personal information stolen from your purse or wallet

Home break in

Automobile theft

Dumpster diving (stealing trash with personal information from a residential or business trash receptacle)

Personal information on your imprinted checks

Medical or school records that are accessed by an untrustworthy employee

Information you provide to a fraudulent telemarketer

Information you supply over the Internet

Thieves are also obtaining children’s Social Security numbers to commit identity theft. The Federal Trade Commission (FTC) provides helpful information about how you can safeguard your child’s information and help minimize their risk of identity theft. Visit the FTC website to learn more.

Review our Identity Theft Toolkit to learn more about how to protect yourself.

Review the FTC Consumer Information related to Identity Theft

How to Report Fraud

Fraudulent emails and websites:

Suspicious online transactions:

(559) 437-7700 or 1-800-538-3328

Report a lost or stolen EECU ATM/Debit Card:

Within the U.S.

1-800-538-3328

1-800-234-5354-After hours

Outside of the U.S.

00-1-515-457-2080

Report a lost or stolen EECU Visa Credit Card:

Within the U.S.

1-800-538-3328

1-800-234-5354-After hours

Outside of the U.S.

00-1-515-457-2080

Call collect +1-303-967-1096